SNITCH: The ₹520 Cr Profitability Leap - India's D2C Fast Fashion Strategy

SNITCH: India’s D2C Fast Fashion Strategy, ₹520 Cr Revenue & 5X EBITDA

Executive Summary: Sustained Hyper-Growth and 5X Profitability

SNITCH, the Bengaluru-based menswear fast fashion brand, has cemented its position as a profitable D2C leader by achieving unprecedented financial growth in FY25. Founded in 2019, the brand successfully pivoted from B2B to D2C and is now mastering the omnichannel strategy with profitability as its core focus.

The latest unaudited figures for FY25 reveal a massive scale-up:

Revenue Surge: Operating revenue nearly doubled from ₹243 Cr in FY24 to approximately ₹520 Cr in FY25.

EBITDA Zoom: Profitability improved dramatically, with EBITDA soaring almost 5X Year-on-Year to approximately ₹30 Cr in FY25.

Strategic Shift: This financial leap was driven by a 50% reduction in marketing costs, enabled by successful offline expansion and phenomenal customer retention.

| Metric | Launch (June 2020) | FY24 (Audited) | FY25 (Unaudited) | FY26 (Target) |

Net Sales/Revenue | ₹31 Lakh (First Month) | ₹243 Cr | ₹520 Cr | ₹1,000 Cr |

EBITDA | N/A | N/A | ~₹30 Cr (5X YoY) | N/A |

Net Profit | Bootstrapped/Initial loss | ₹4.4 Cr | Not Disclosed (NP) | IPO Trigger at ₹100 Cr NP |

Sales Mix (Offline/D2C) | 0% Offline | ~30% Offline | 40-45% Offline | 50% Offline |

1. The D2C Pivot: Why SNITCH is Winning

1.1 Fast Fashion Engine: Speed and Control

SNITCH’s competitive edge remains its agility. The brand is vertically integrated, utilizing in-house manufacturing control to maintain a quick design-to-market cycle. This ensures fresh, trendy menswear is released every few days, minimizing inventory risk and maximizing appeal to its target demographic: Gen Z and young millennials (18-35 years). This focus on rapid iteration and direct feedback from the D2C fashion model allows SNITCH to stay ahead of market trends, a crucial factor in the volatile Indian apparel market.

[Image 2: A dynamic shot inside the SNITCH 15,000 sq ft warehouse. The image should feature a well-organized logistics operation, possibly showing staff quickly processing orders or showcasing the large volume of their 8,000 SKUs being prepared for shipment.]

“

1.2 Unlocking Profitability: The Marketing Cost Revolution

A key factor in the 5X EBITDA growth is the strategic reduction in spending. SNITCH saw its marketing costs drop by 50% in FY25. This was achieved by:

Channel Focus: 80% of sales now come from its own channels (website, app, and stores), reducing reliance on expensive marketplace commissions, which now account for only 15% of total revenue. This shift highlights a mature D2C strategy focused on direct customer relationships.

Retention Excellence: The brand has built a “strong brand” that drives loyalty, resulting in a phenomenal retention rate exceeding 100% at both order and revenue levels. High retention directly translates to lower Customer Acquisition Cost (CAC), fueling profitability and making SNITCH a case study in sustainable growth.

2. The Power of Omnichannel and Customer Loyalty

2.1 Retail Stores: Driving AOV and Loyalty

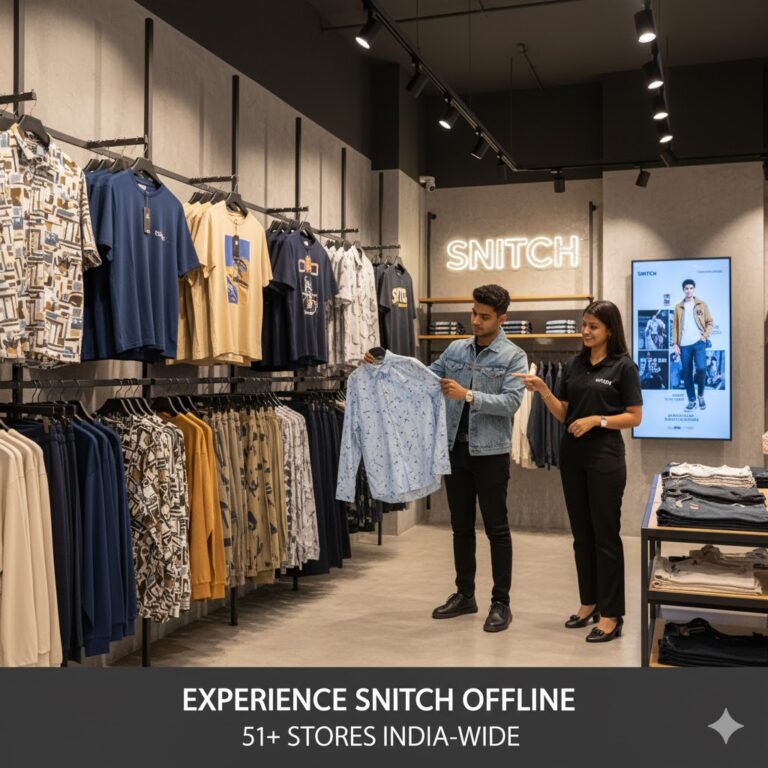

SNITCH’s aggressive offline expansion is not just about reach; it’s a core profitability driver.

Growth: The offline contribution to revenue jumped significantly from $\sim$30% in FY24 to 40-45% in FY25. This signals a successful omnichannel strategy that blends online convenience with physical touchpoints.

Store Performance: The brand currently operates 51 profitable stores across India (including Ahmedabad, Delhi, Hyderabad, and Pune), with all stores reportedly achieving a strong retention rate. These physical stores serve as key brand-building assets and revenue generators for the menswear D2C brand.

Offline Spending: Crucially, many customers who initially shopped online are now purchasing offline, with their offline spending increasing by nearly 2.5 times compared to their online Average Order Value (AOV). This demonstrates the power of integrated shopping experiences.

[Image 3: A sleek, modern photograph of one of SNITCH’s physical retail stores on a high-street location. The store should be well-lit, displaying their signature trendy menswear and ideally showing a customer interacting with the collection.]

“

2.2 Operational Readiness and Future Categories

The company’s robust logistics, which grew from a 200 sq ft space to a 15,000 sq ft warehouse, ensures smooth fulfillment. While managing a 30% RTO rate is an industry challenge for online fashion brands, the direct-to-consumer model provides invaluable feedback for continuous improvement in sizing and customer service.

The focus on omnichannel strategy continues with plans to launch 50 new stores in the next six months and an expansion into new product categories in FY26, including pluswear, bags, footwear, and sunglasses. This expansion into related segments aims to increase customer lifetime value and capture a larger share of the men’s fashion market.

[Image 4: A stylized flat-lay image of a young man (target demographic 18-35) scrolling through the SNITCH mobile app or website on his phone, surrounded by a few trendy SNITCH clothing items (e.g., a co-ord set, a graphic tee).]

“

3. The Billion-Dollar Vision and IPO Roadmap

3.1 Financial Credibility and Investor Trust

SNITCH’s significant growth trajectory—from ₹11 Cr to ₹520 Cr in four years—is underpinned by strategic funding (totaling $\sim$13.4 Mn) and high-profile deals like the Shark Tank India appearance, which boosted its valuation to over ₹2,500 Cr. This investor confidence reflects the market’s belief in SNITCH’s D2C strategy and its ability to capture a substantial share of the Indian apparel market.

3.2 The IPO Trigger

Founder Siddharth Dungarwal has set a clear path for a public listing (IPO by FY30). The preparation for the IPO will commence only after the brand achieves a net profit of ₹100 Cr. This goal underscores the management’s focus on sustainable, large-scale profitability, a critical metric for a successful public offering.

3.3 Global Ambition

In addition to dominating the Indian market, SNITCH is planning its global foray, starting with a pilot in the Middle East by December 2025. This strategic move positions the brand to compete on an international level, challenging the established dominance of global fast fashion giants like H&M and Zara by leveraging its proven D2C playbook.

Conclusion: The SNITCH Playbook for D2C Success

SNITCH’s story is a compelling blueprint for profitable D2C growth in the Indian apparel market. By combining the agility of a fast fashion operator with the economic efficiency of an omnichannel strategy, SNITCH successfully transformed high customer loyalty into low marketing costs and spectacular EBITDA growth. The brand is firmly on track for its ₹1,000 Cr revenue target for FY26, demonstrating that controlled growth and a customer-first approach are the undeniable keys to scaling a menswear D2C empire. As SNITCH continues its journey towards a ₹1,000 Cr valuation and beyond, it stands as a testament to strategic execution and market understanding in the dynamic world of D2C fashion brands